Barrick exits Donlin Gold in $1.1bn deal with Paulson and NOVAGOLD

Canadian miner Barrick Gold on Wednesday announced a deal to divest its 50% stake in the Donlin Gold project in Alaska for up to $1.1-billion, marking an exit from the asset while strengthening its focus on Tier 1 operations.

The buyers – long-time NOVAGOLD investor Paulson Advisers and NOVAGOLD itself – will become joint owners of one of North America's largest undeveloped gold projects.

Paulson will acquire an 80% interest in Barrick’s share of Donlin Gold for $800-million, while NOVAGOLD will acquire the remaining 20% for $200-million, raising its overall ownership in the project to 60%.

The remaining 40% will now be held by Paulson, whose chairperson, John Paulson, described Donlin Gold as "one of the most attractive development gold projects in the world".

The deal also includes an option for NOVAGOLD to buy out $100-million in debt owed to Barrick, at a discount if completed before closing. The transaction is expected to close in late second quarter or early third quarter, subject to regulatory approvals.

“The Donlin agreement allows Barrick to exit the Donlin Gold project at an attractive valuation, while allowing NOVAGOLD and Paulson to pursue the development of the project,” said Barrick CEO Mark Bristow.

“This is a good example of an instance where an asset we own might be better suited in the hands of others," he stated.

The proceeds will be used to strengthen Barrick’s balance sheet, invest in core growth projects, and deliver returns to shareholders, the company said.

For NOVAGOLD, the deal represents a chance to advance the project that has long been stalled in the pre-development phase. The company has secured $170-million in equity funding commitments from Paulson, Electrum Group, and Kopernik Global Investors to finance the acquisition, with a further $30-million to be drawn from its treasury.

“The announcement of our new partner, Paulson, marks the watershed moment in our company’s ambition to unlock conscientiously the full value of Donlin Gold,” said NOVAGOLD chairperson Thomas Kaplan. “For such a prescient and illustrious gold investor as John Paulson to share our belief… is truly catalytic for NOVAGOLD.”

"For myriad reasons, Paulson is quite literally the finest partner we could have hoped for. The embodiment of ‘smart money’, John has been recognized as having a unique ability to identify the right vehicle to execute legendary trades. John and his team’s expertise and counsel will be invaluable as we work to advance Donlin Gold through feasibility and financing.”

The partners plan to immediately relaunch technical and permitting work on the project, including an updated feasibility study, reserve and resource conversion drilling, and further exploration on the underexplored land package.

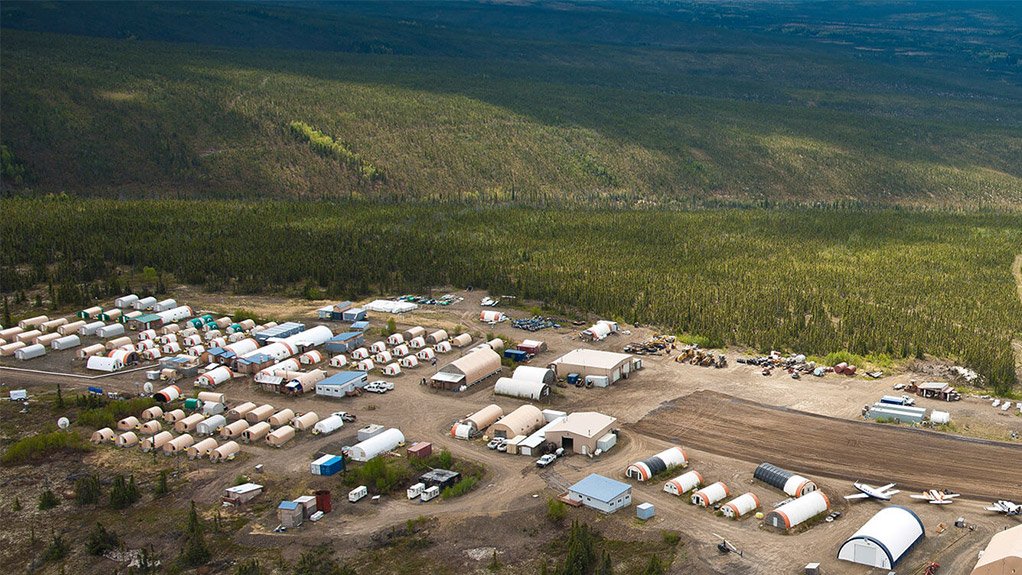

Located in Alaska’s Kuskokwim region, Donlin Gold boasts 39-million ounces of gold in measured and indicated resources at 2.24 g/t — more than double the industry average. A 2021 study estimated a mine life of 27 years and average yearly output of 1.1-million ounces. The deposit is just 3 km of an 8 km mineralised trend.

The project has received support from Alaska Native landowners Calista Corporation and The Kuskokwim Corporation (TKC), both of whom welcomed Paulson’s involvement.

“We strongly welcome Paulson as a new partner – together we can create a future that respects our heritage while embracing economic opportunities,” said Calista CEO Andrew Guy in a statement distributed by NOVAGOLD.

“The advancement of the Donlin Gold project represents a once-in-a-generation opportunity,” added Andrea Gusty, CEO of TKC. “Like all development, it must be guided by our obligation to steward the land.”

Paulson’s deep roots in the gold sector, including as a cornerstone investor in Detour Gold prior to its acquisition by Agnico Eagle, give NOVAGOLD a heavyweight partner as it prepares to enter a new development phase. Paulson has been invested in NOVAGOLD since 2010 and is currently its second-largest shareholder.

“Donlin Gold constitutes a superb opportunity for us to gain leverage to gold in the United States at an attractive valuation,” said Paulson. “Together with Donlin Gold’s partners, Calista and TKC, we are dedicated to responsibly advance the Donlin Gold project.”

NOVAGOLD and Paulson will operate the venture under a newly revised limited liability agreement, giving both parties equal governance rights. The updated partnership aims to strike a balance between advancing a world-class resource and maintaining strong environmental and community stewardship.

The partners said they will revisit the project’s $43-million 2025 budget in light of the transaction and broader development plans.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation